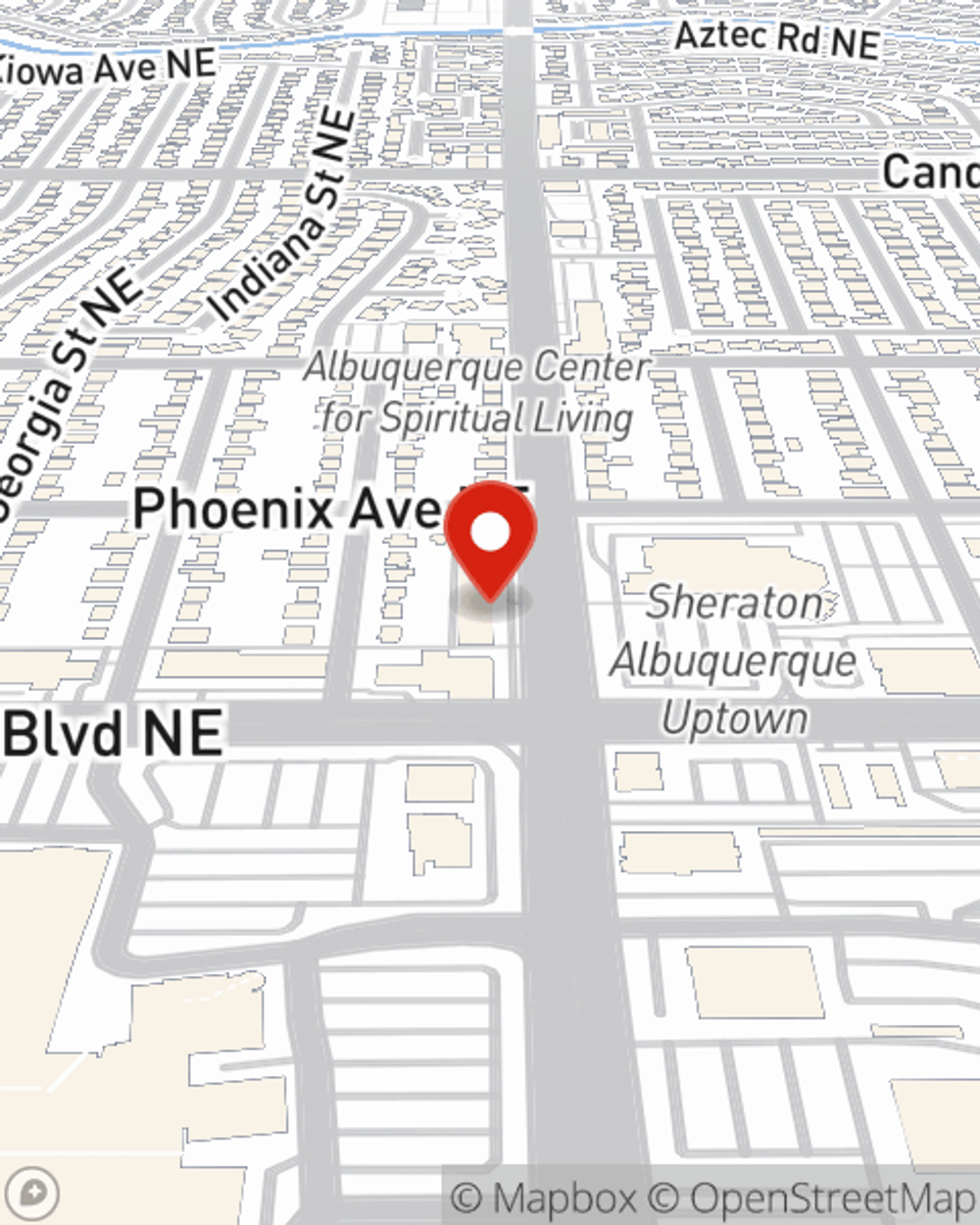

Business Insurance in and around Albuquerque

One of Albuquerque’s top choices for small business insurance.

This small business insurance is not risky

This Coverage Is Worth It.

When you're a business owner, there's so much to focus on. We understand. State Farm agent Rigo Castillo-Sanchez is a business owner, too. Let Rigo Castillo-Sanchez help you make sure that your business is properly insured. You won't regret it!

One of Albuquerque’s top choices for small business insurance.

This small business insurance is not risky

Customizable Coverage For Your Business

For your small business, whether it's a floral shop, a boutique, a bagel shop, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business liability, business property, and extra expense.

When you get a policy through the reliable name for small business insurance, your small business will thank you. Call or email State Farm agent Rigo Castillo-Sanchez's team today with any questions you may have.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Rigo Castillo-Sanchez

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.